America, Get Ready for the Double Dip

Finally the debt ceiling drama is over and for the first time in history U.S. credit rating has been downgraded? What does it all mean for our economy? Unfortunately, a double dip recession. This is what I foresee, even though, contrary to expectations, interest rates have sunk following the downgrade. Ignoring dire warnings issued by experts during the debt-ceiling brawl in July, I invested in Treasury bonds, expecting interest rates to plummet following any deficit reduction deal.

This is exactly what has happened and bond prices have soared. I think the economy will weaken fast and bonds will rise further.

It is all a matter of demand and supply. A healthy economy requires a balance between these two forces, i.e., for an economy to create jobs and avoid recession, it is essential that

Supply = Demand

Please don’t be alarmed by this equation, because I am sure you have heard of these concepts and they need not be explained in detail. They offer great insight into what has happened over the past three decades. The main source of supply or production of goods is productivity, whereas the main source of demand are wages. Layoffs occur only when supply exceeds demand so that some goods remain unsold, profits fall, and businesses have to fire workers. Thus wages have to be proportionate to productivity if the supply-demand equation is to remain in balance, which in turn avoids unemployment.

Because of new technology and investment, productivity generally rises every year, which means production or supply increases every year. Then wages must also rise in the same proportion so demand keeps up with supply. Otherwise, supply exceeds demand and layoffs inevitably follow. This is the simple logic that governs the creation or dismissal of jobs.

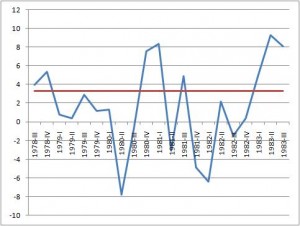

Ever since 1981, when Reagan became president, government policies have changed so much that productivity has been outpacing wages. The policies of restraint over the minimum wage, free trade, outsourcing, among others, created an ever growing gap between wages and productivity. Click here for more details. As supply grew faster than demand, the government began to print money and bring down interest rates to lure people into debt. Led by Fed Chairman Alan Greenspan, money growth jumped again and again and consumer debt grew sharply. This way the economic balance was maintained and joblessness avoided because now

Supply = Demand + Consumer Borrowing

However, the wage-productivity gap kept rising and even the ever growing consumer debt was insufficient to maintain economic equilibrium. So the government also had to raise its own spending year after year. In this case, layoffs were avoided because then

Supply = Demand + Consumer Borrowing + Government Budget Deficit

Now you can see why, and how, America became a nation of debtors at every level. In today’s world, the equation is no longer that supply equals demand, but that supply equals spending out of wages and new debt.

However, the debt creating measures cannot succeed forever. A time comes when consumers run out of good collateral such as home equity, and then banks stop lending. Such a time arrived in 2007, and a year later, since the economy had been running on debt for so long, supply massively exceeded demand, and large scale layoffs followed. With consumer borrowing screeching to a halt, government deficit had to sky-rocket to maintain the equation’s balance, and to keep the recession from turning into a depression. From a few hundred billion dollars a year, the deficit jumped into trillions, which in turn made the rating downgrade inevitable. With Standard & Poor’s downgrading many nations in Europe because of their high debt, it had to take similar action for the United States as well.

Let me give you examples of how the supply-demand logic has helped me make a variety of forecasts since 1999, when I wrote a book called, The Crash of the Millennium, predicting a stock market crash in 2000. In 1999 there was a rare budget surplus which caused supply to exceed demand, so profits fell and shares began to crash from January 2000. In fact, Greenspan, who knew no economics, had supported the creation of that surplus, thereby generating the supply-demand gap and the inevitable crash. A budget surplus is toxic in an environment of ever rising wage-productivity gap, but Greenspan was unaware of this logic. As I had expected, following the crash he printed oodles of money and sharply lowered interest rates that in turn spawned a housing bubble.

By this time I was fed up with his manipulation of money growth, and in 2005 published a book with a blunt title, Greenspan’s Fraud, where I argued that his policies were fooling experts all over the world but they would soon bring about a serious recession. Economists laughed at my gall and the title of my book and many actually endorsed Greenspan’s actions. I countered by writing another book in 2006 and called it The New Golden Age: The Coming Revolution against Political Corruption and Economic Chaos. In this I predicted that a major slump would start in mid-2007 with a housing crisis and then convulse the world through stock market crashes, soaring unemployment, mega bankruptcies and exploding budget deficits. However, eventually there would be a golden age of unprecedented prosperity, because a fed up public would throw out corrupt politicians and elect ethical candidates who in turn would introduce genuine economic reforms to fix the problems.

The first part of these forecasts, to my great sorrow, has already come true. The second half will likely materialize in the next four years. Let us take another look at the economic-balance equation:

Supply = Demand + Consumer Borrowing + Budget Deficit

Since even now productivity continues to rise, supply will keep rising for a while, but, with both wages and consumer borrowing flat, the budget deficit must rise further to maintain balance in the equation and hence the economy. As the deficit is going to fall, another round of imbalance and hence layoffs is inevitable. 2012 will look really bad.

The Federal Reserve could again pump up the money supply, and that could slow the coming slump temporarily, but things will only get worse after six months. The reason is that the Fed has been doing this for three years now, and all it has done is to boost share prices as well as oil. The oil price had dropped to about $32 per barrel by the end of 2008. Then came the Bush-bailout and a sharp jump in money supply, both of which stuffed the pockets of multimillionaires and billionaires, who in turn used the government money to stab us all in the back: they resumed speculating in oil. So by now, oil is hovering around $90 per barrel.

In the past, even in a minor recession or growth slowdown, oil would sink to around $10. This happened in 1986, 1989 and 1999. But not anymore. The biggest slump since the 1930s has produced a $90 oil. Such is the by-product of official corruption that has ignored anti-trust laws and permitted mergers among giant oil companies since the days of Bill Clinton. Exxon-Mobil among other behemoths, along with an army of hedge funds, is now busy speculating in oil, and in the process killing the global economy.

Ever since the early 1980s, American economy has been so mismanaged that it cannot live without the federal deficit. Add to this the phenomenon of oil speculation, and you have a perfect recipe for a prolonged recession. Major deficit cuts are scheduled in 2013, and if they really come to pass, then the recession could turn into a depression. At that point, even oil will collapse to $10. Gold perhaps will rise further especially if the Fed injects more money. Otherwise, gold could also collapse.

I am sorry for ruining your day, but hopes offered by experts and politicians cannot trump the supply-demand logic. The Soviet Union tried to violate the laws of supply and demand, and in the process it vanished. The saddest thing of it all is that the American economy can be easily fixed and brought back to full employment in less than 18 months by gradually decreasing the wage-productivity gap. I have discussed these reforms in detail in my books, but space does not permit me to explore them here. All I can say is that all the economic policies that the administrations have followed in the past 30 years must be scrapped or modified so that wages catch up with productivity. That indeed will be a revolution.

*Ravi Batra is a professor of economics at Southern Methodist University, Dallas, Texas. His website is ravibatra.com.

I hope Dr. Batra will be unanimously be selected as Chairman of Federal reserve at the Dawn of New Golden Age of Economic Democracy.

All the Best.