Casino Capitalism and Collapse of the American Economy

COLLAPSE OF THE AMERICAN ECONOMY

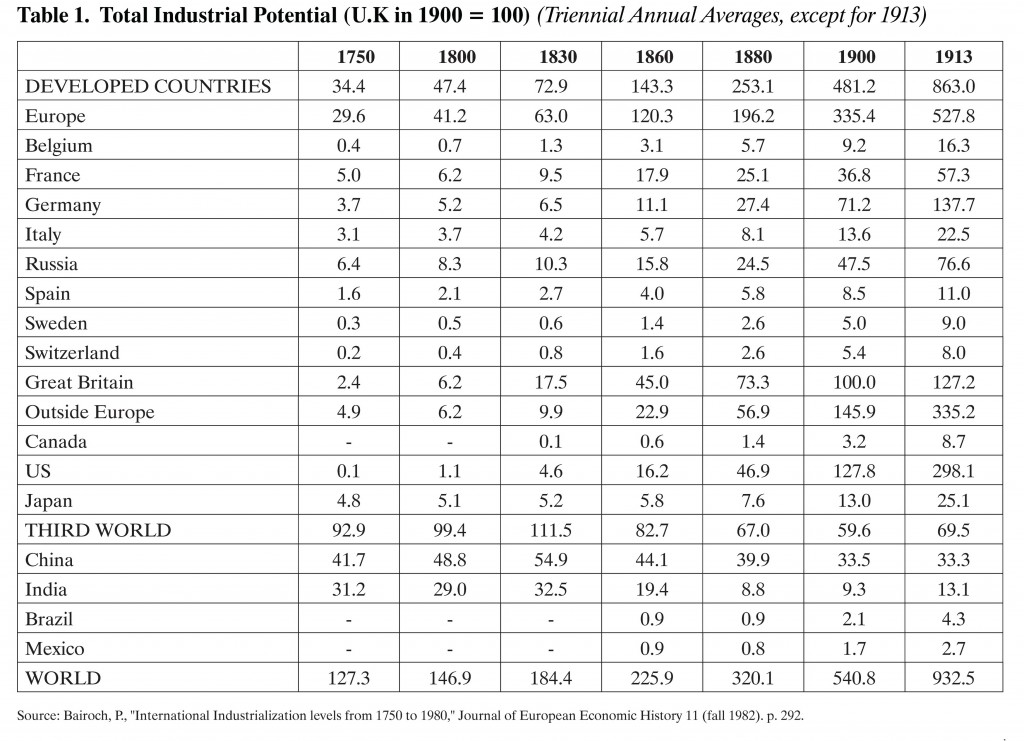

The debt crisis started by the Reagan administration is becoming unsustainable. Although the Clinton administration was able to balance the budget, and even had budget surpluses its last two years, it was unable to rein in the balance of payment (BPO) deficit, which has increased from $140 billion in 1997 to $738 billion in 2007. Figure 1 shows the U.S. debt from 1960 to 2007. The chart clearly shows that the debt rose at a faster rate during republican administrations. The curve is concave during the Clinton administration, when the increase in the debt was the slowest. The Bush administration, to compound the difficulty, has increased U.S. fiscal debt from $5.6 trillion to $9 trillion because of tax breaks and increasing defense expenditures. Taking advantage of the fact that the dollar is the global currency, the Fed prints money whenever it feels necessary in order to fund the two deficits we now have—the trade deficit and the budget deficit. However, these large, accumulating sums are not sustainable.

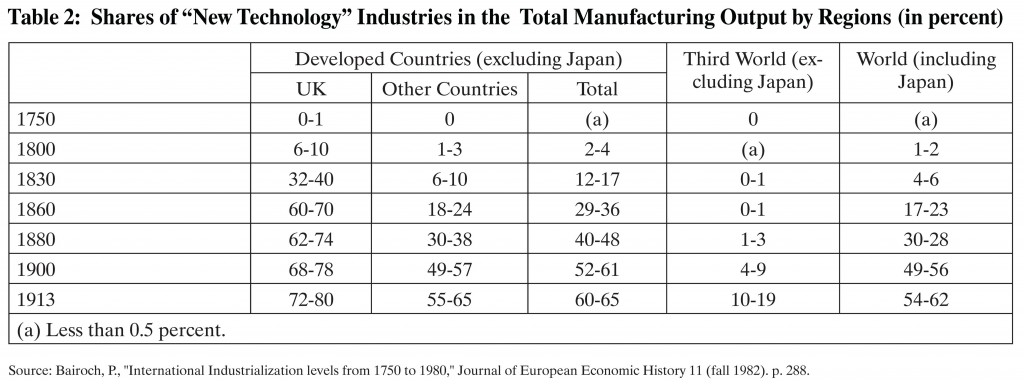

Figure 2 shows the U.S. BOP as a percent of GDP from 1930 to 2007, and Figure 3 shows the BOP in billions of dollars from 1990 to 2007. The BOP has deteriorated very fast since 2000, with the beginning of the Bush administration, and is now in uncharted territory. In terms of percent of GDP, this is the first time the BOP has been allowed to drop to this level in American history. During the mid-1980s when it started going into what was then also uncharted territory, the U.S. had to sign the 1985 Plaza Accord (shown as the vertical line in Figure 2) and cooperated in a controlled depreciation of the dollar in order to increase its exports. At that time, all the main players in the global economy—Japan, West Germany, France, and the U.K.—were dependent on the U.S. for their security and so helped it in this endeavor. China and Russia are the world’s largest and third largest FOREX holders now, however, and most of their FOREX is in dollars; they may not do what the U.S. wants. They have seen the fate of the “bubble economy” of the late 1980s and 1990s in Japan due to the Plaza Accord, and will likely hesitate to sign a similar accord. They may even prefer to see the U.S. economy collapse rather than protect it.

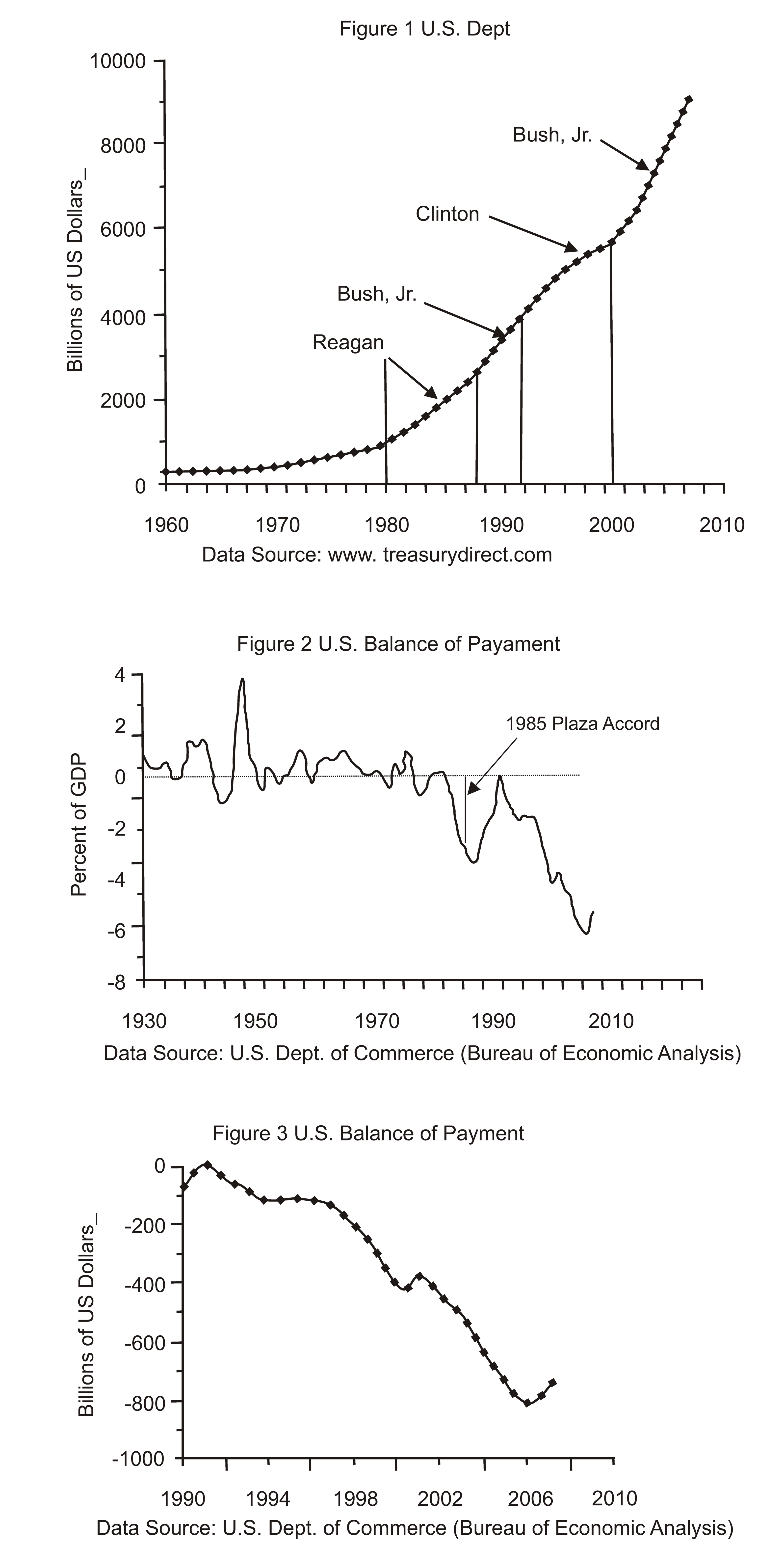

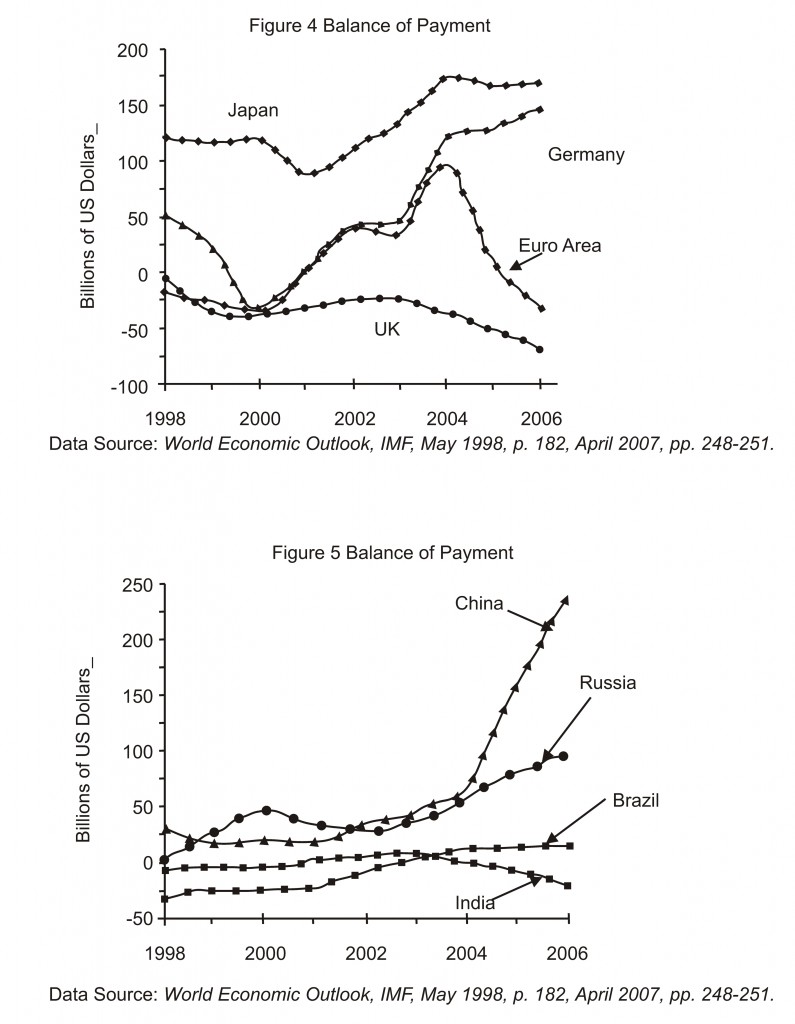

Figures 4 and 5 show the BOP’s of selected countries. All countries except U.K. and India have positive BOPs in the past several years. The main reason behind the negative BOP of India is the import of gasoline. India needs to follow in the footsteps of Brazil and find a substitute for petrol as soon as possible, otherwise it may face an economic crisis because it is the only country in BRIC that has a negative BOP. India has the second highest arable land after the U.S. and hence it can produce a sufficient amount of ethanol. In Brazil, no small vehicles run on pure gasoline; instead they use ethanol-mixed gasoline, which is available all over the country.

Due to the housing crisis, the US trade deficit is expected to reduce slightly. In 2007, the U.S. BOP reduced to $738 billion from $811 billon in 2006. According to April 2008 IMF estimates, the U.S. BOP deficit will continue to be above $600 billion for the next five years - $614 billion in 2008, $605 billion in 2009 and $676 billion in 2013. On the other hand, its two main adversaries, China ($1.5 trillion at the end of 2007, $1.9 trillion at the end of 2008 and $2.4 trillion at the end of 2009) and Russia ($445 billion at the end of 2007, $583 billion at the end of 2008 and $708 billion at the end of 2009) will be amassing FOREX (Foreign Reserves) at alarming rates. It is worth noting that China and Russia had only $168.9 billion and $24.8 billion FOREX, respectively, in 2000.

According to economist Allan H. Meltzer at Carnegie Mellon University, “We [US] get cheap goods in exchange for pieces of paper, which we can print at a great rate.” However, the mountain of U.S. bonds foreigners are accumulating means the country is going deeper into debt to fund its import binge. According to William R. Cline, a scholar at the Institute for International Economics, “Sooner or later, the rest of the world will decide that the U.S. is no longer a safe bet for lending more money.” According to Brad Setser, an economist with Roubini Global Economics, LLC, in New York, in order to pay for its imports the U.S. needs to attract foreign capital at the rate of about $20 billion a week [i.e. to finance $1 trillion dollar twin deficit a year, consisting of $700 billion trade deficit and $300 billion budget deficit]. This is equal to selling three companies the size of the maritime firm supposed to be purchased by Dubai Ports World. “We are basically selling off the furniture to pay for Thanksgiving dinner,” says Peter Morici, a professor at the University of Maryland’s business school in College Park. According to him, foreigners could own within the next decade more than a fifth of the nation’s total $35 trillion or so in assets of every kind – corporations, businesses and real estate.

President-elect Barack Obama is going to spend trillions of dollars in the next couple of years on development projects to get the country out of the present deep recession; but, this huge spending has the potential to crash the entire US economy because of massive foreign debts. It all depends on how foreign investors like China react to these massive new US debts, i.e. it is a million dollar question whether China will cooperate with the US so that the US can spend itself out of a deep recession or not, because China is holding $2 trillion. In a similar situation, the US and German banks did not help Gorbachev in the late 1980s that led to the collapse of the U.S.S.R.

After record-breaking prices in the early 1980s, oil prices plummeted in the second half of the decade. Oil was the main export and source of hard currency for the U.S.S.R. Insufficient investment and lack of modern technology needed to harness hard-to-reach oil fields prevented her from expanding production, however, and in fact Soviet oil production began to decline. The government was also borrowing heavily to modernize its economy. These two factors led to a rise in Soviet external debt. In 1985, oil earnings and net debt were $22 billion and $18 billion, respectively; by 1989, these numbers had become $13 billion and $44 billion, respectively. By 1991, when external debt was $57 billion, creditors (many of whom were major German banks) stopped making loans and started demanding repayments, causing the Soviet economy to collapse.

As discussed in my book, The Modernization Islam and the Creation of A Multipolar World Order, the 1930s Great Depression resulted in the rise of Hitler, who tried to establish a thousand years of Third Reich, but instead paved the way for thriving democracies in most of Europe and decolonization in Asia and Europe. Similarly, the coming Great Depression will result in the collapse of capitalism, a secular and democratic Middle East, and enduring peace for the entire humanity.

Stiglitz, Joseph, “The Insider: What I Learned at the World Economic Crisis,” The New Republic, April 17, 2000.

Stiglitz, Joseph E., Globalization and Its Discontents, W.W. Norton Co., New York, 2003, p 208.

Ibid., pp. 129-130.

Krugman, Paul, “Fuels on the Hill,” The New York Times, June 27, 2008.

World Economic Outlook, IMF, April 2008, p. 258, and p. 266.

Blustein, Paul, “U.S. Trade Deficit Hangs In a Delicate Imbalance,” Washington Post, November 19, 2005.

Blustein, Paul, “Mideast Investment up in U.S.,” The Washington Post, March 7, 2006.

Fracis, David R., “The U.S. is for Sale – and Foreign Investors are Buying,” The Christian Science Monitor, June 9, 2008.

Sachs, Jeffrey D., The End Of Poverty, The Penguin Press, New York, 2005, p. 132.